Welcome to Nebraskans Supporting the Fair Tax – the Nebraska arm of Americans For Fair Taxation, the organization promoting the FAIRtax®! We support AFFT’s efforts to replace the Federal Income Tax with a national consumption sales tax, thereby eliminating the IRS.

At the state level, we promote principles of good taxation — to eliminate confiscatory taxes and replace them with broad-based, flat consumption taxes. By taxing only consumers we recognize what Pres. Calvin Coolidge knew, “in the end [taxes] come out of the people who toil.” Informing fellow Nebraskans and our legislators of this truth will help Nebraska become more economically attractive among our neighboring states.

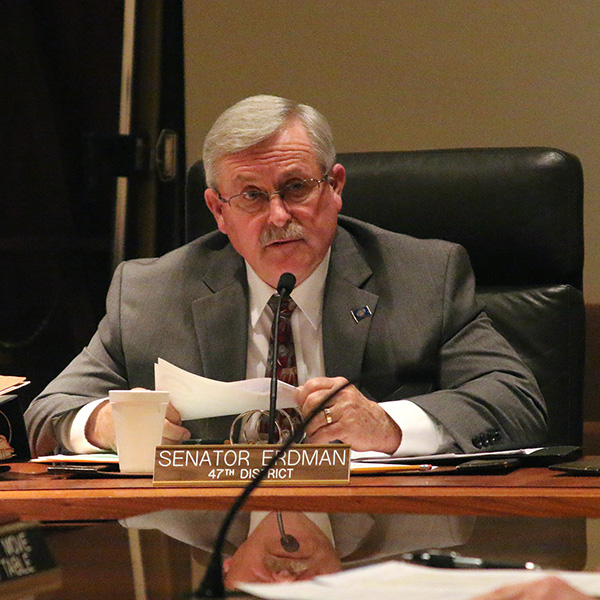

On 1/23/20, Senator Steve Erdman of Bayard introduced LR 300 CA, the EPIC tax reform bill, which combines Nebraska’s “three legged stool” into one consumption-based tax, eliminating confiscatory taxes on both property and income.

Questions? If the articles below do not satisfy your curiosity, please email our president and state AFFT director, Rob Rohrbough, at:

Want to stay in touch? Sign up for updates here!

Adjusting any existing tax falls short of real reform. It still leaves confiscatory taxation in place. The Framers of this country’s Constitution provided for a system of taxation that honors our property rights. We are on the move in Nebraska — restructuring Nebraska’s system of taxation to return those rights to Nebraskans once again.

Help us restore your rights! Check out these stories:

July FAIRtax Online Meeting

Beyond LR 300 CA:

Meaningful Tax Reform

Online Webinar

Tuesday, June 2, 6:30 PM – 8 PM

Registration Required. Click here to Register

After registering, you will receive a confirmation email containing information about joining the webinar.

Agenda:

- Login and networking (6:45 – 7:00)

- Introductions & Business Meeting (7:00)

- Program — update from June

- Wrap up (8:00)

Mark Bonkiewicz’ 40 year background in sales and professional speaking makes him a natural for protecting families and strengthening conservative values. He is a dynamic leader who champions the protection of the health and innocence of children with passion and faith.

Rob Rohrbough is President of Nebraskans supporting Fair Tax, holding that role since 2014. An Omaha Native, he applies his experience from a career in technology to defending Liberty in the area of taxation and from internal and external threats to our culture of Americanism, without which Liberty cannot be attained.

Rob Rohrbough is President of Nebraskans supporting Fair Tax, holding that role since 2014. An Omaha Native, he applies his experience from a career in technology to defending Liberty in the area of taxation and from internal and external threats to our culture of Americanism, without which Liberty cannot be attained.

Registration is required, here. For more information:

https://www.facebook.com/NebraskansSupportingtheFairTax/

or Info@NEFAIRtax.org

Our March Meeting!

Sen. Steve Erdman on LR 300 CA

Last week, Sen. Steve Erdman came to Omaha to discuss his priority bill, Legislative Resoli=ution 300, a proposed amendment to Nebraska’s constitution. This amendment would prohibit all forms of taxation except a consumption tax on services and new goods. WOWT covered the event in this video:

Resources for LR 300 CA

We are gratified at the excitement and enthusiasm for this sweeping tax overhaul in Nebraska. Many questions have been asked including just how it works. In response to that, we have included several resources here. Just click on the item to open the resource, mostly PDF files you can view and download:

- A Nuts and Bolts Guide to the Nebraska Consumption Tax

- Brochure

- A Packet of Consumption Tax Materials

- Legislative Resolution 300 CA

LR 300 CA Gets Hearing in the Revenue Committee

On Wednesday, February 12, the Revenue Committee heard testimony on this resolution, which would give farmers, business and home owners the relief that the Unicameral hasn’t been able to provide for the last half century!

On Wednesday, February 12, the Revenue Committee heard testimony on this resolution, which would give farmers, business and home owners the relief that the Unicameral hasn’t been able to provide for the last half century!

Please contact Rob by email, Rob@NEFAIRtax.org , or by calling 402-3697-6915, for more information.

LR 300 CA Introduced!

On January 23rd, the last day to introduce bills in the Unicameral, Sen. Steve Erdman and nine co-sponsors introduced a Legislative Resolution, 300 CA, proposing to amend the Nebraska Constitution to eliminate both property taxes and the state income tax. It would replace the current sales tax with a limited base to a broad-base consumption tax on services and new goods. On Wednesday, February 12, the Revenue Committee heard testimony on this resolution, which would give farmers and homeowners the relief that the Unicameral hasn’t been able to provide for the last half century!

Please contact Rob by email, Rob@NEFAIRtax.org , or by calling 402-3697-6915, for more information.

Dan Pilla's Ten Principles of Federal Taxation

Want to understand why you should take a good look at the FAIRtax? Dan Pilla is one of the foremost tax experts in the country. He is considered to be “the nation’s leader in taxpayers’ rights defense and IRS abuse prevention and cure” according to The Heartland Institute. If you don’t like to read and have time, you may watch his presentation on The Heartland Institute’s website. If you do not have the hour that takes, you may glance at his analysis in writing. In either case, you will understand good and bad taxation better than you ever have before!

Want to understand why you should take a good look at the FAIRtax? Dan Pilla is one of the foremost tax experts in the country. He is considered to be “the nation’s leader in taxpayers’ rights defense and IRS abuse prevention and cure” according to The Heartland Institute. If you don’t like to read and have time, you may watch his presentation on The Heartland Institute’s website. If you do not have the hour that takes, you may glance at his analysis in writing. In either case, you will understand good and bad taxation better than you ever have before!

Should the IRS Be Abolished?

Can it be fixed? Take a look at this Washington Examiner article.

The Case for the Fair Tax®

Check out former Senator John Linder’s articulate case for the Fair Tax® at Hillsdale College:

It is a fine presentation that answers all your questions! If you don’t think so, message us from our FaceBook site.

Think your property is safe with the IRS?

Just ask the owners of a grocery store in Michigan! Read what George Will has to say about it here. This could happen in Nebraska… Abuses like this and the IRS all go away with the Fair Tax®!

So, You Think Your Taxes are High?

The Complex Tax Code is not helping the economy or average folks, according to Tom Purcell, in Thursday’s Omaha World Herald. You may read about it here.

New FaceBook Page

Please feel free to Like our new FaceBook page, NebraskansSupportingtheFairTax! Then look for additional posts and news. We started with a video from Kerry Bowers, who walks through the features every tax code should have and grades our current income tax code along with the FairTax – HR 25/S 13.

A Little Tax History

On April 15, what better day than for historian, Bill Federer, to come out with an article on the history of the income tax and its nefarious impact on American life:

The Income Tax: Root of all Evil

When I talk to people about the Fair Tax®, I ask them this question: Among three major forms of taxes – the property tax, income and related taxes (withholding, estate tax), and a consumption tax – which one respects our unalienable right to property? The property tax is pretty obvious – especially on non-income producing property like our residences. When we pay property tax to the state at the risk of losing our house to a tax sale, we really do not own it; we rent it from the government. How about income? Is not the income we earn our own property? If this is not so obvious, take a look at this classic article from the The Ludwig von Mises Institute.

Fair Tax® Can Be Applied at the State Level

We have been asked if the Fair Tax® concept can be applied at the state level. It most certainly can, and Nebraska Fair Tax ® has developed a proposal to replace Nebraska’s income tax and sales tax with strictly a consumption tax.

It would eliminate the state income tax and all its related taxes, including both the state withholding tax and the state inheritance tax. The details of the proposal may be found in this PDF file.

The Problem with Property Taxes

Until recently most activists considered the Fair Tax to be a national (Federal) issue. We now consider it to be a state level issue as well. Why? No better case can be made than this from David Barton and Rick Green as they interview Texas State Representative Phil King. Do other forms of taxes, like the property tax, violate our moral code? Just listen to this!